The Democrats’ Paranormal Economics

US government debt now stands at $20 trillion, or roughly 100% of GDP. This should be a concern, but Democratic economists are not worried. A much-discussed November 30 paper by former Treasury Secretary Lawrence Summers and former Council of Economic Advisors Chairman Jason Furman suggests that Democratic thinking has veered into the paranormal, with an emphasis on levitation. Governments will be able to borrow and spend as much as they want for whatever purpose they want, the authors argue in so many words, and interest rates will remain low forever.

As Washington Post editorialist Charles Lane commented Dec. 7, “Far from burdening future generations, governments have a golden opportunity to fund long-standing needs by borrowing for investments in future prosperity—the list includes child care, early education, job training and clean water.”

The argument so easily refuted by casual reference to the facts that it takes a doctorate from Harvard (which both Summers and Furman hold) to suspend disbelief in the obvious. The authors aver:

We note that with massive increases in budget deficits and government debt, expansions in social insurance, and sharp reductions in capital tax rates, one would have expected to see increasing real rates if private sector behavior had remained constant. We suggest that changes in the supply of saving associated with lengthening life expectancy, rising uncertainty and increased inequality along with reductions in the demand for capital associated with demographic changes, demassification of the economy, and perhaps changes in corporate behavior have driven real interest rates down.

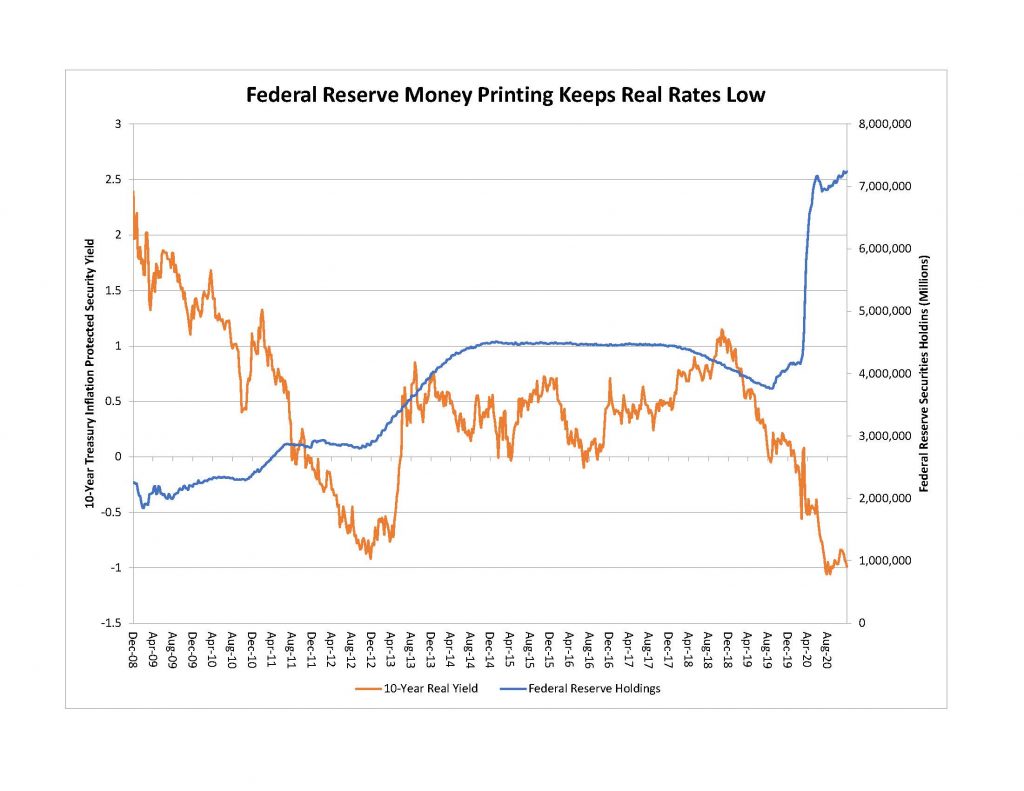

This characterization is rather like Hamlet without the Ghost, for the ghost in the interest machine during the past decade has been the Federal Reserve Board’s multi-trillion-dollar purchases of Treasury and agency securities. Summers and Furman do not mention this in their 50-page excursus.

It surely is the case that the aging of the industrial nations’ population prompts people to save more, and that higher savings rates depress interest rates, but the collapse of real Treasury yields to the negative 1% range during the course of 2020 had nothing to do with the savings rate, but rather with the Federal Reserve’s unprecedented purchases of public debt.

No deleterious consequences attach to the explosion of public debt, according to Summers and Furman, who

… reconsider traditional views about the dangers of debt and deficits. We note that in a world of unused capacity and very low interest rates and costs of capital, concerns about crowding out of desirable private investment that were warranted a generation ago have much less force today. We argue that debt-to-GDP ratios are a misleading metric of fiscal sustainability that do not reflect the fact that both the present value of GDP has risen and debt service costs have fallen as interest rates have fallen. Instead we propose that it is more appropriate to compare debt stocks to the present value of GDP or interest rate flows with GDP flows.

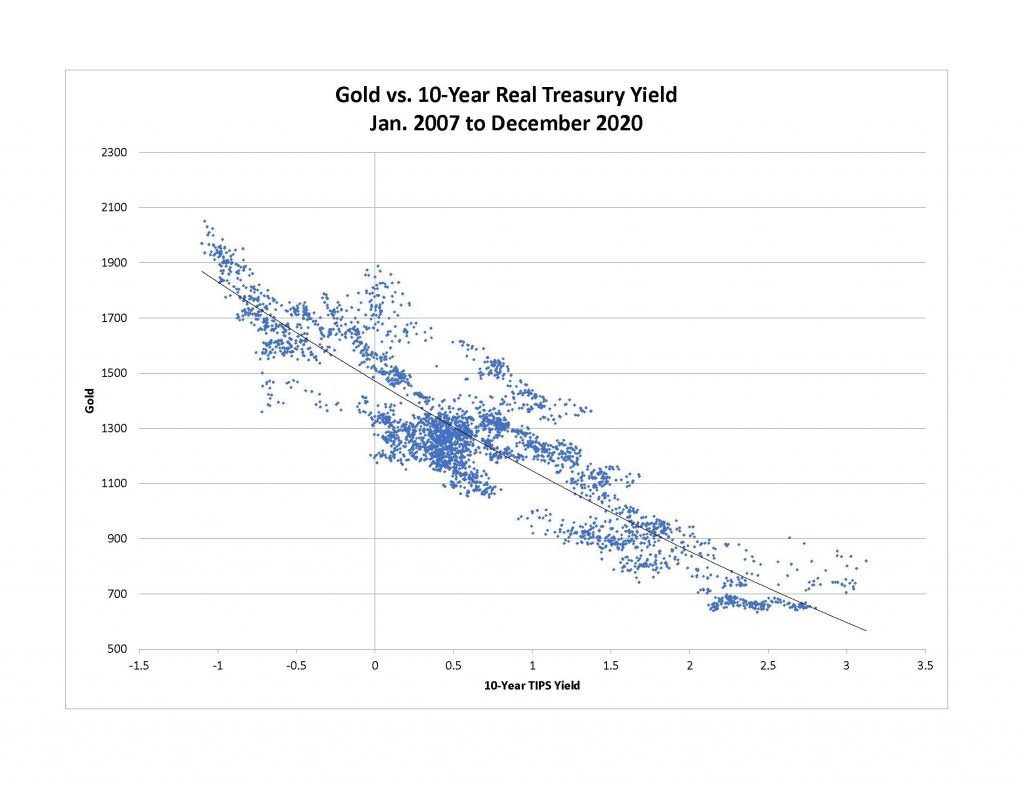

But it is perverse to use “interest rate flows” as a benchmark, because the interest rate is manipulated downward by the Federal Reserve (which, as noted, the authors do not mention). The collapse of real yields during quantitative easing, moreover, puts the US dollar and the whole currency system at risk. This is reflected in the price of gold, which roughly tripled during quantitative easing, and tracked the fall in real Treasury yields closely.

The 10-year TIPS yield explains about 80% of the change in the gold price during the past thirteen years (the r2 of regression of gold against the 10-year TIPS yield is 0.8). That is no surprise, because the two assets have similar functions. Gold is not a currency (because most governments do not make it legal tender), but it is a sort of shadow currency, a “primitive relic” (Keynes) to which countries must fall back if the value of fiat currency collapses. In effect, gold is an insurance policy against currency collapse. Inflation-indexed Treasuries perform a similar function; if the dollar collapses and inflation rises sharply, they will protect investors. They also offer protection in the case of extreme deflation (because their coupon rise when the Consumer Price Index rises, but does not fall if the Consumer Price Index turns negative).

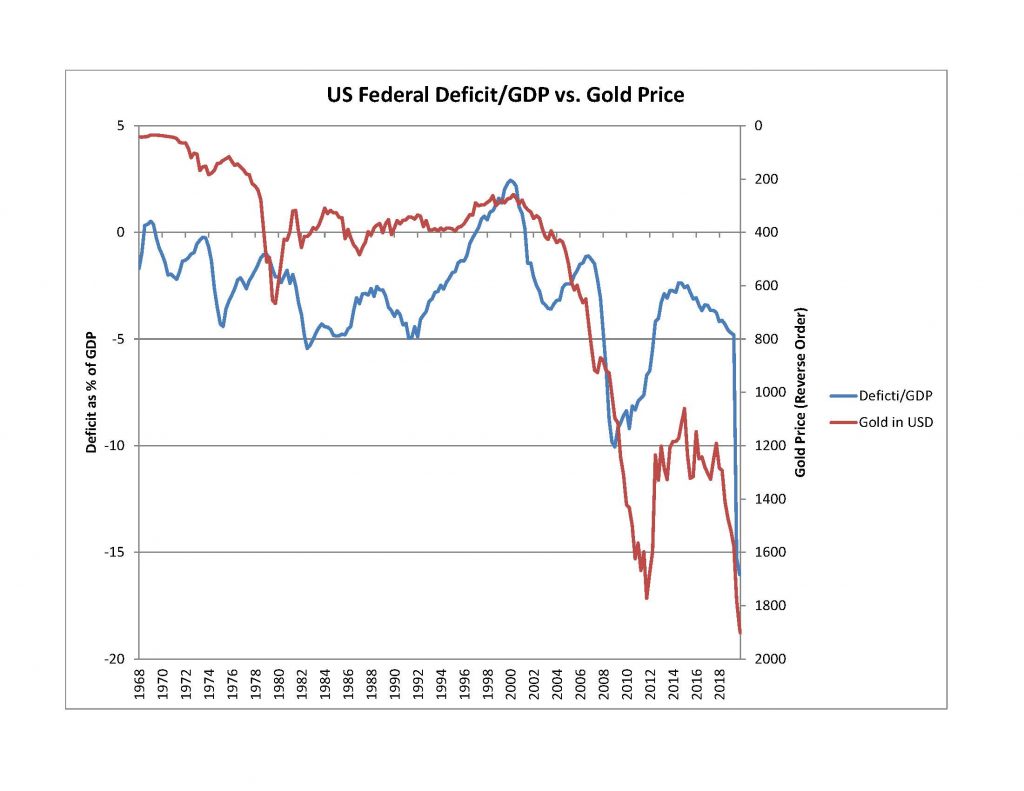

The close relationship between real interest rates and gold makes clear that the risk to the monetary system has increased drastically as the deficit rose during the past decade and a half. The decline in real interest rates thus reflects a higher price for hedges against extreme movements in the value of the national currency (as the price of inflation-indexed securities rises, the yield falls). We observe the same pattern in the long-term relationship between the US federal deficit (expressed as a percentage of nominal GDP) and gold. The greater our deficit, the more the world is willing to pay for insurance against the collapse of our currency.

The price of insurance against a currency collapse has risen, but that does not mean such a collapse is inevitable. Why can’t the United States simply ignore the warning signals, as Furman and Summers propose, and continue to borrow and spend? Japan’s government debt now stands at 240% of GDP, more than twice the American ratio. Japan appears able to sustain a much higher debt burden. Why can’t the United States?

If the United States were to issue debt in order to rebuild its industrial base and reduce the current account deficit, increased debt might be justified. That is not the form that deficit spending is likely to take under a Biden Administration, which is likely to offer lip service to investment in technology while spending lavishly on social and environmental programs.

The difference is that Japan has a current account surplus and nearly $4 trillion in net foreign assets, while the US has a current account deficit and a net international investment position of negative $13 trillion. Japan finances its government debt by selling bonds to Japanese institutions and households. The dollar is the world’s principal reserve currency, which gives the United States the benefit of free or cheap credit from the rest of the world. Foreigners hold trillions of dollars of deposits in dollars to pay for transactions, and these constitute a loan to the United States.

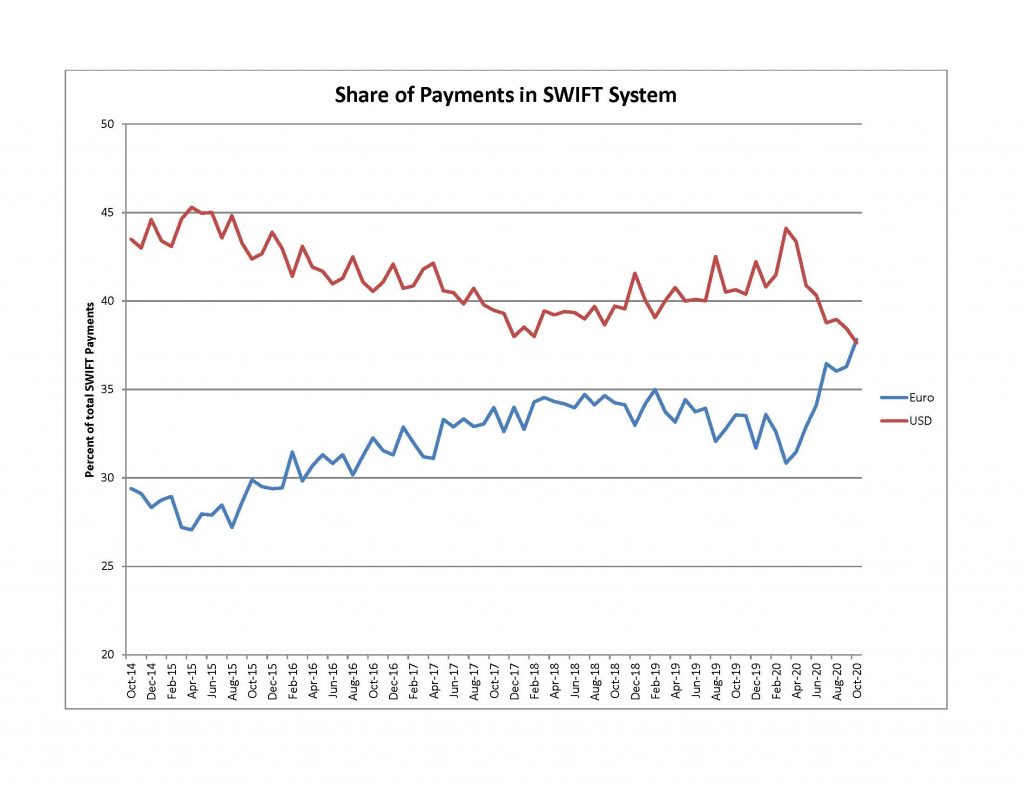

I do not believe that the dollar’s reserve status is in immediate danger, but the world has shifted markedly away from dollars during the past several years. As of late 2020 the world cleared as many transactions in Euros as in dollars through the interbank SWIFT electronic transfer system.

The dollar may be overripe as a world reserve currency, but there is no easy replacement. Japan and Europe have economic problems of their own. Gold is extremely cumbersome as a substitute for electronic transfers, and digital currencies do not inspire the same confidence as fiat currencies backed by central banks and governments that can collect taxes. China’s RMB is a possible competitor to the dollar in the long term, but China has no intention to field its currency as a dollar substitute in the short- or medium-term. Its capital markets are too immature to support a global reserve instrument. A reserve currency is a mixed blessing, because it exposes the domestic financial system of the issuer to global pressures and volatility.

The fact that the reserve status of the dollar is no immediate danger should not lull us into complacency. China is not ready to field the RMB as a replacement for the dollar, but at present growth rates its economy will become larger than America’s in dollar terms by the mid-2020’s (it is already larger according to the International Monetary Fund’s measure of purchasing power parity), and it will seek a monetary status commensurate with its economic power. China may be cautious for the present, but its geopolitical and economic ambitions will give rise to a challenge to the dollar’s reserve status between five and ten years from now. We have a few years’ grace to get our house in order, but not a decade.

Within the time horizon of the next US election cycle, the likelihood is that the United States can continue to increase its debt. That, almost certainly, is what the Biden Administration will attempt to do. If the United States were to issue debt in order to rebuild its industrial base and reduce the current account deficit, increased debt might be justified. That is not the form that deficit spending is likely to take under a Biden Administration, which is likely to offer lip service to investment in technology while spending lavishly on social and environmental programs.

It is magical thinking to believe that the United States can run large deficits indefinitely. The closest equivalent to America’s position today is Britain during the 1970s, when the collapse of the pound’s reserve role forced a series of currency devaluations and budget cuts. China’s economy will be as large as America’s in dollar terms within a few years, and Beijing’s financial reforms are preparing the way for an eventual challenge to the dollar’s reserve status. If the Biden Administration listens to Furman and Summers, we shall have to burn that bridge when we come to it.

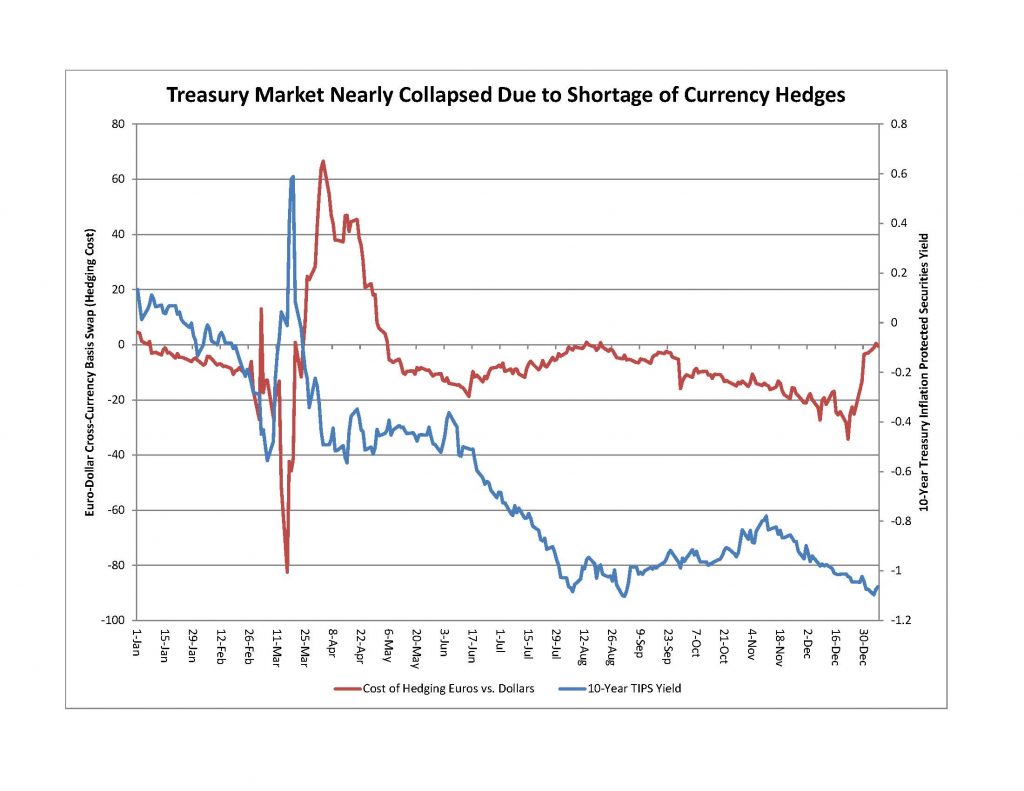

Fault lines in the financial system could produce a crisis in dollar funding much earlier. A crisis in the US government debt market nearly erupted in March, due to forced liquidation of Treasury securities by foreign investors. Germany and Japan have negative real interest rates, so their investors buy American bonds at positive real interest rates. But Germans and Japanese have to pay out Euros and yen, not dollars. Under the present regime of floating exchange rates, currency fluctuations can diminish the value of US dollar bonds held by foreign investors. These investments must be hedged against currency risk. Foreign portfolio investors go to their banks to swap dollar income into local-currency income. The banks borrow dollars in the United States, sell them in the forward market and receive Euros and yen.

European banks are running out of borrowing capacity. After five years of negative short-term rates, their profitability is low, their stock prices are falling and their credit is deteriorating. They can no longer borrow the dollars required to construct the hedges that local investors need.

Foreign exchange derivatives form the biggest mountain of obligations in the world financial system—a notional amount of about $90 trillion, up from $60 trillion in 2010. Breaking down the numbers, Bank for International Settlements (BIS) economists showed that the foreign exchange derivatives taken on by non-financial corporations tracked the growth of world trade, and the derivative obligations of nonbank financial institutions—money managers and insurance companies—tracked international securities investments.

Bank for International Settlements (BIS) economists noted three years ago that non-US banks now owe $10.7 trillion in US dollars, most of which reflects the hedging requirements of these global flows. The banks don’t report foreign exchange swaps with their customers on their balance sheets, but the BIS estimates that these obligations amount to $13 or $14 trillion.

For some time, international bank regulators and the International Monetary Fund have warned that the banking system no longer can support these enormous flows. The Federal Reserve is tightening liquidity in the US, and in a volatile market, European banks might not be able to roll over nearly $11 trillion of short-term obligations—and might default.

As the BIS warned in September 2017:

The combination of balance sheet vulnerabilities and market tightening could trigger funding problems in the event of market strains. Market turbulence may make it more difficult for banks to manage currency gaps in volatile swap markets, possibly rendering some banks unable to roll over short-term dollar funding. Banks could then act as an amplifier of market strains if funding pressures were to compel banks to sell assets in a turbulent market to pay their liabilities that are due. Funding pressure could also induce banks to shrink dollar lending to non-US borrowers, thus reducing credit availability. Ultimately, there is a risk that banks could default on their dollar obligations.

Something like this nearly happened in March 2020, when a global shortage of dollar liquidity hit European banks, who cut off funding for foreign-exchange hedges, forcing their customers to liquidate US Treasuries.

The Federal Reserve immediately made more than $1 billion of dollar liquidity available to European banks through swap lines, and the brief spike in Treasury yields disappeared. I believe that the Treasury and Federal Reserve have the resources to control such episodes for the time being, but they can’t do so forever.