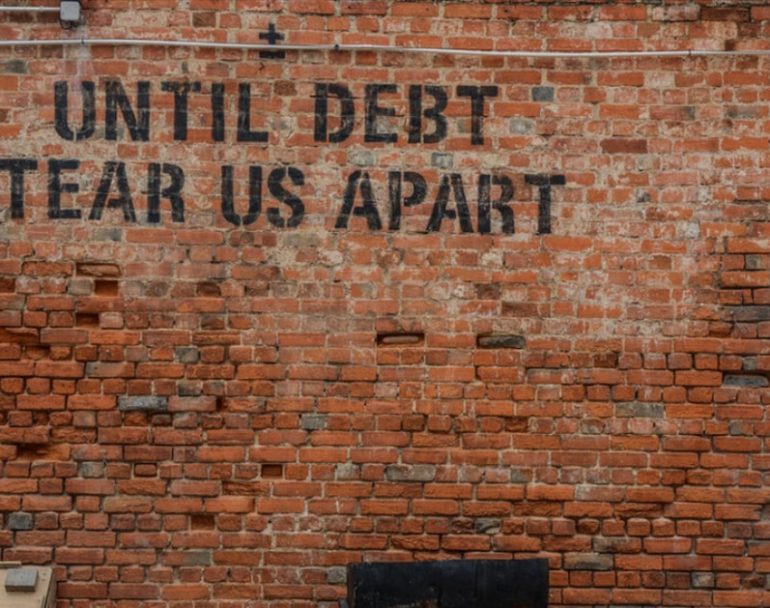

Full Speed to a Fiscal Cliff: National Debt Hits $22 Trillion

By: Mike Maharrey

The national debt has pushed above the $22 trillion mark and is up $2.06 trillion since Donald Trump took office.

According to Treasury Department data released Tuesday, the national debt now stands at $22.01 trillion. When President Trump took office in January 2017, the debt was at $19.95 trillion.

And the pace of borrowing doesn’t show any signs of slowing down. The CBO projects that the 2019 budget deficit (government spending over revenue) will come in at $897 billion. That’s a 15.1% increase over the 2018 deficit of $779 billion. (If you’re wondering how the debt can grow by a larger number than the annual deficit, economist Mark Brandly explains here.)

According to the CBO, the deficit will hit $1 trillion by 2022 and remain at that level or higher through 2029. Keep in mind, the CBO tends toward conservative projections. As Peterson Foundation CEO Michael Peterson put it, the $22 trillion milestone is “the latest sign that our fiscal situation is not only unsustainable, but accelerating.”

Although the economy is supposedly in the midst of a boom, U.S. government borrowing looks more like we’re in the midst of a deep recession. Long-term US debt sales have risen to a level not seen since the height of the financial crisis. According to Treasury Borrowing Advisory Committee calculations, the Treasury Department will need to sell a staggering $12 trillion in bonds over the next decade. Even without factoring in the possibility of a recession this will “pose a unique challenge for Treasury.”

Just consider the increasing amount of money necessary just to make interest payments on all of this debt. According to the Peterson Foundation, the federal government already pays out $1 billion every single day just servicing the interest on the debt. It will fork out a staggering $7 trillion in interest payments over the next decade.

Growing debt coupled with soaring interest payments creates a vicious upwardly spiraling cycle. As debt grows, it costs more money to service it. That requires more borrowing, which adds to the debt, which increases the interest payments — and on and on it goes.

This is an underlying reason that the Federal Reserve simply cannot continue raising interest rates. The increasing number of bonds on the market alone will naturally push yields (interest rates) higher as a function of supply and demand. That may well put the Fed into a position of once again having to become a buyer of US Treasuries. In other words, more quantitative easing. Interestingly, the Fed is considering using QE “more readily” in the future. Perhaps the central bankers realize that there is no way the U.S. government can continue this borrowing pace without the Fed monetizing the debt.

The Trump administration insists that its tax cuts will eventually pay for themselves by generating faster economic growth But as we have said repeatedly, high levels of debt retard economic growth. Several studies estimate that economic growth slows by about 30% when the debt to GDP ratio rises to about 90%. The CBO projects the US will hit 106% debt to GDP ratio in the next decade, but most analysts say the U.S. economy is already in the 105% range.

Trump supporters try to deflect blame away from the president, pointing out that Congress ultimately passes all spending bills. This doesn’t reflect very well on the Republicans who controlled both houses of Congress as the debt skyrocketed by over $2 trillion. And it doesn’t let the president off the hook. As Tenth Amendment Center founder and executive director Micheal Boldin pointed out, they are all responsible for the debt.

Nevertheless, politicians in D.C. seem utterly unconcerned about the skyrocketing debt. Trump didn’t even mention the debt during the State of the Union speech and few people on Capitol Hill have made the growing deficits an issue. Peterson said despite the apathy in D.C., we should be concerned about the skyrocketing debt.

Our growing national debt matters because it threatens the economic future of every American.”