Central Bank Digital Currency: Paper Money isn’t the Solution

By: Mike Maharrey

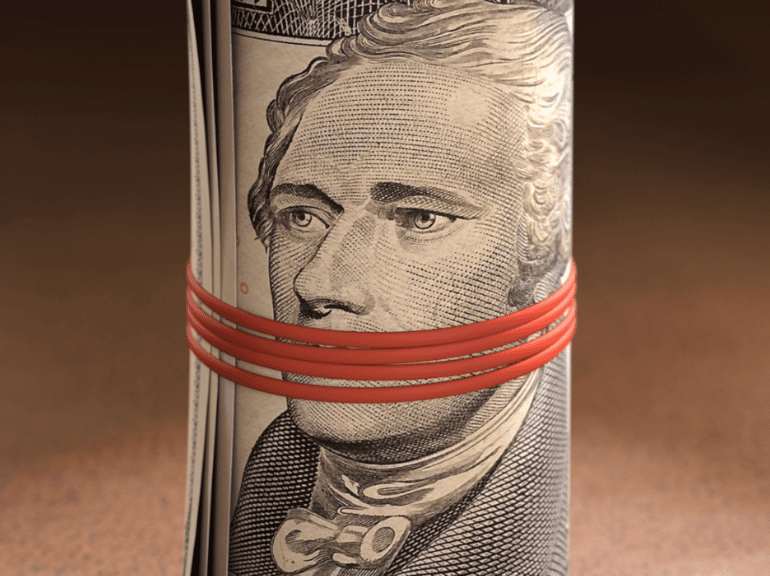

Physical paper money solves some of the privacy and security issues inherent in central bank digital currencies (CBDCs). But a lot of people seem to have forgotten that government-issued paper fiat is the parent of a CBDC, and it won’t solve the more fundamental problem – whether physical or digital, fiat currency isn’t real money.

What Is CBDC?

Digital currencies are virtual banknotes or coins held in a digital wallet on your computer or smartphone. The difference between a central bank (government) digital currency and peer-to-peer electronic cash such as bitcoin is that the value of the digital currency is backed and controlled by the government, just like traditional paper fiat currency. In fact, a Federal Reserve-issued CBDC would just be a dollar in another form.

But the specter of a CBDC raises new concerns relating to financial privacy and the potential for government control.

At the root of the move toward CBDC is what some call “the war on cash.” For years, governments have looked for ways to eliminate physical cash because it is hard to control. I can put it under my mattress and nobody has to even know I have it. And if you and I do a cash transaction, no record exists. That’s a problem for government officials who would like to tax our transactions, or possibly prohibit them altogether.

Enter CBDCs.

Government-issued digital currencies are sold on the promise of providing a safe, convenient, and more secure alternative to physical cash. We’re also told they will help “stop dangerous criminals” who like the intractability of cash. But there is a darker side – the promise of control. CBDC creates the potential for the government to track and even micromanage consumer spending.

Imagine if there was no cash. It would be impossible to hide even the smallest transaction from the government’s eyes. Something as simple as your morning trip to get a coffee wouldn’t be a secret from government officials. As Bloomberg put it in an article published when China launched a digital yuan pilot program in 2020, digital currency “offers China’s authorities a degree of control never possible with physical money.”

The government could even “turn off” an individual’s ability to make purchases. Bloomberg described just how much control a digital currency could give Chinese officials.

The PBOC has also indicated that it could put limits on the sizes of some transactions, or even require an appointment to make large ones. Some observers wonder whether payments could be linked to the emerging social-credit system, wherein citizens with exemplary behavior are ‘whitelisted’ for privileges, while those with criminal and other infractions find themselves left out. ‘China’s goal is not to make payments more convenient but to replace cash, so it can keep closer tabs on people than it already does,’ argues Aaron Brown, a crypto investor who writes for Bloomberg Opinion.”

Economist Thorsten Polleit outlined the potential for Big Brother-like government control with the advent of a digital euro in an article published by the Mises Wire. As he put it, “the path to becoming a surveillance state regime will accelerate considerably” if and when a digital currency is issued.

You can see why governments are keen on implementing CBDC as quickly as possible.

Is Paper Money the Solution?

As the push to implement CBDC intensifies, opponents are lobbying for policies to preserve the right to use cash, primarily in the form of the US Dollar (USD). This makes sense on the surface. If people have the option to use physical currency, they can simply avoid a CBDC and the inherent control it would provide government actors.

But in the clamor to minimize the impact of CBDC, many have lost sight of the inherent problems with paper fiat money.

As George Mason put it, “The laws making paper currency a legal tender have produced great and numerous evils.”

Thomas Jefferson went further, declaring that “paper is poverty, it is only the ghost of money and not money itself.”

A CBDC would certainly give government more control than it has today, but don’t forget that the government’s monopoly on money, and the Federal Reserve’s ability to create it out of thin air, gives it plenty of control to begin with.

In fact, the Fed is the engine that drives the biggest government in history.

The problem with fiat money – paper or digital – is the Fed can just fire up the proverbial printing press and make more when the government wants to pay for something. That means there is virtually no restraint on government spending already – and on government power. But when the government just creates trillions of dollars out of thin air, it also erodes away the purchasing power. That makes you poorer.

As Thomas Jefferson warned, “We are to be ruined now by the deluge of bank paper.”

Paper currency is the parent of a CBDC. Central bank digital currency is the same old dollar in a new form with the same problem as paper. Instead of printing new dollars, the Fed can create new digital dollars with a keystroke. Instead of a deluge of paper, we will get a deluge of electronic digits.

In fact, the economy has already moved mostly in that direction with the advent of credit cards and electronic payment systems.

Granted, CBDCs create new worries about privacy and control, but that is not a reason to suddenly embrace the USD as the solution to all of our problems.

But that’s what a lot of people seem to be doing. They’re telling us we have to protect and promote the fiat US Dollar in order to fight a CBDC because government digital currency is so bad. As one opponent of government digital currency put it, “I used to be really critical of Federal Reserve notes. … Compared to CBDC, U.S. Federal Reserve note cash will be wonderful. We will miss it when it is gone.” [Emphasis added]

Note he “used to be” really critical of the USD. Apparently, he’s not anymore because CBDC is so much worse. This mentality drives people away from opposing the original evil that led us here in the first place.

It’s important to remember that Federal Reserve notes were always an evil. CBDC is all of that evil plus some. But that doesn’t make the original evil good or something that should be preserved.

John Adams compared government overreach to cancer.

“The nature of the encroachment upon the American constitution is such, as to grow every day more and more encroaching. Like a cancer, it eats faster and faster every hour.”

What do you do to cancer?

You remove it.

And when cancer metastasizes, you don’t just remove the metastasis; you remove it and the original tumor. No sane person would embrace the original cancer just because the metastasis is worse.

The Path Forward

Relying on fiat paper money might alleviate some of the problems of a CBDC, but it doesn’t strike the root of the problem. The government might not be able to track every purchase if you use paper money, but it will still devalue your dollar every single day – and expand its own power while doing so.

We need currency competition.

That means finding sound money alternatives to federal government-produced and controlled fiat money.

This could come in the form of gold, silver, or non-government cryptocurrencies such as Bitcoin. It could even involve ways of transacting business we haven’t even thought of yet. But we need money that is not subject to Federal Reserve and government control and manipulation.

Supporting one form of government money over another is not a long-term solution, nor will it ever push the needle forward for the Constitution and liberty.