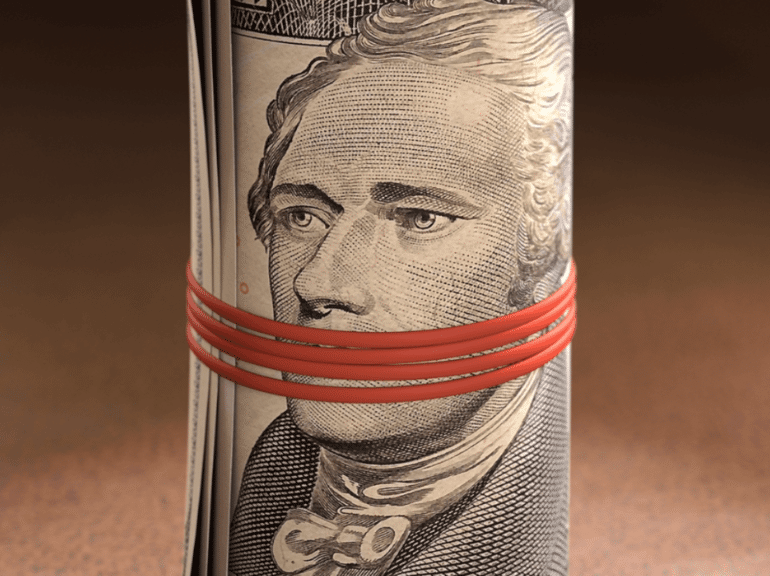

Paper Money: The Founders Warned Us!

By: Michael Boldin

“The evils of paper money have no end”

That’s how Thomas Paine put it, but he was far from alone. The Founding Fathers were deeply worried about the dangers of paper money, because they lived them first hand.

They repeatedly warned us about how it would give us price inflation, empower big government, act as a hidden tax, and as George Washington put it, facilitate “every species of fraud and injustice.”

Thomas Jefferson, observing the detrimental effects of an inflationary paper money system, wrote to Edward Carrington, “paper is poverty, that it is only the ghost of money, and not money itself.”

Paine took a similar position, noting that “Money is Money, and Paper is Paper. – All the invention of man cannot make them otherwise.”

That, of course, doesn’t mean that paper is useless. Paine put it this way:

“THE only proper use for paper, in the room of money, is to write promissory notes and obligations of payment in specie upon. A piece of paper, thus written and signed, is worth the sum it is given for, if the person who gives it is able to pay it; because in this case, the law will oblige him.”

In this situation, the paper is merely a note – a promise to pay in real money. But, as Paine continued, the paper itself holds no value:

“But if he is worth nothing, the paper-note is worth nothing. The value, therefore, of such a note, is not in the note itself, for that is but paper and promise, but in the man who is obliged to redeem it with gold or silver.”

CAUSE OF PRICE INFLATION

What most of us today call inflation – the founders called “depreciation.” That’s because they recognized that across-the-board price increases were a result of money having less value – less purchasing power.

That, of course, is caused by an increase in the supply of money – and credit. Benjamin Franklin described it like this:

“It has been long & often observed, that when the current Money of a Country is augmented beyond the Occasions for Money, as a Medium of Commerce, its Value as Money diminishes, its Interest is reduced, and the Principal sinks if some Means are not found to take off the surplus Quantity.”

Samuel Adams made a similar observation:

“Every Body sees that the Depreciation of the Paper Currency is owing to the Floods of it which have been necessarily issued.”

Writing to Thomas Jefferson, William Fleming recognized this cause and effect as well:

“Provisions, and all kinds of goods rise in proportion to the depreciation of the paper money.”

In 1786 – Jefferson explained the history of how this played out during the War for Independence. He noted that within the first two years – the purchasing power of the paper money dropped pretty significantly. But from there, the depreciation just kept getting worse and worse.

“In two years it had fallen to two dollars of paper for one of silver. In three years to 4. for 1., in 9. months more it fell to 10. for 1. and in the six months following, that is to say, by Sep. 1779. it had fallen to 20. for 1.”

When Congress tried to “fix” things by price fixing the money at 40 to 1 – it still kept getting worse:

“This effort was as unavailing as the former. Very little of the money was brought in. It continued to circulate and to depreciate till the end of 1780., when it had fallen to 75. for one”

EMPOWERS GOVERNMENT

Jefferson continued by explaining WHY they did this money printing – it empowered the government to do things it couldn’t do without.

“On the commencement of the late revolution, Congress had no money. The external commerce of the states being suppressed, the farmer could not sell his produce, and of course could not pay a tax. Congress had no resource then but in paper money. Not being able to lay a tax for it’s redemption they could only promise that taxes should be laid for that purpose so as to redeem the bills by a certain day.”

Thomas Paine made a similar observation in a letter to George Washington:

“The finances of Congress, depending wholly on emissions of paper money, were exhausted. Its credit was gone. The continental treasury was not able to pay the expence of a brigade of waggons to transport the necessary stores to the army, and yet the sole object, the establishment of the revolution, was a thing of remote distance. The time I am now speaking of is the latter end of the year 1780.”

HIDDEN TAX

In short, when government is too big for its revenues, it either has to reduce in size, raise taxes and collect them or inflate the money supply – which acts as a tax on the people.

Benjamin Franklin described it like this:

“The general Effect of the Depreciation among the Inhabitants of the States, has been this, that it has operated as a gradual Tax upon them. Their Business has been done and paid for by the Paper Money, and every Man has paid his Share of this Tax according to the Time he retain’d any of the Money in his Hands, and to the Depreciation within that Time. Thus it has proved a Tax on Money”

Gouverneur Morris recognized that money printing – depreciating its value – acts as a hidden tax on the people:

“The Resources of the Country may be drawn forth by our Paper at the same Time it must be confessed that this Paper will thereby be less valuable. After all the Debt does not increase for a certain Sterling Sum which would have paid it one Year ago will pay it now. The Depreciation in the Interim hath operated as a Tax.”

FACILITATES EVERY SPECIES OF FRAUD AND INJUSTICE

If all that isn’t enough – there’s still more!

Paper money also serves to manipulate markets – and it facilitates all kinds of fraud and injustice. Thomas Paine described it like this:

“ONE of the evils of paper-money is, that it turns the whole country into stock-jobbers. The precariousness of its value and the uncertainty of its fate continually operate, night and day, to produce this destructive effect. Having no real value in itself it depends for support upon accident, caprice and party, and as it is the interest of some to depreciate and of others to raise its value, there is a continual invention going on that destroys the morals of the country.”

Writing to Albert Gallatin, Thomas Jefferson observed that a fiat, paper money system not only drives up prices, it encourages people to take on far more debt than they normally would – similar to how it empowers governments to spend more than they have on hand.

“The flood of paper money, as you well know, had produced an exaggeration of nominal prices and at the same time a facility of obtaining money, which not only encouraged speculations on fictitious capital, but seduced those of real capital, even in private life, to contract debts too freely.”

In a letter to Jabez Bowen of Rhode Island, George Washington may have summed it up best:

“Paper money has had the effect in your State that it ever will have, to ruin commerce – oppress the honest, and open a door to every species of fraud and injustice.”

Here we are, more than two centuries later, and we’re still laboring under this same system of “fraud and injustice.”

As Thomas Jefferson warned, “the evils of this deluge of paper money are not to be removed until our citizens are generally and radically instructed in their cause & consequences”